Top five legal questions when structuring an impact bond

Structuring an impact bond involves the bringing together of a number of aspects – legal, financial, regulatory and tax – in order to develop a transaction that all stakeholders can work with. On the Quality Education India Development Impact Bond (QEI DIB), we worked closely with our legal partners, Reed Smith to navigate through several questions on structuring multi-party impact bond transactions and learnt several lessons along the way. In this article, we invited Reed Smith to talk about the five most important legal questions to consider when structuring an impact bond and why getting these right in the initial phase of a transaction can save a lot of time and cost throughout the life cycle of the transaction.

1. How do the payments flow through the transaction?

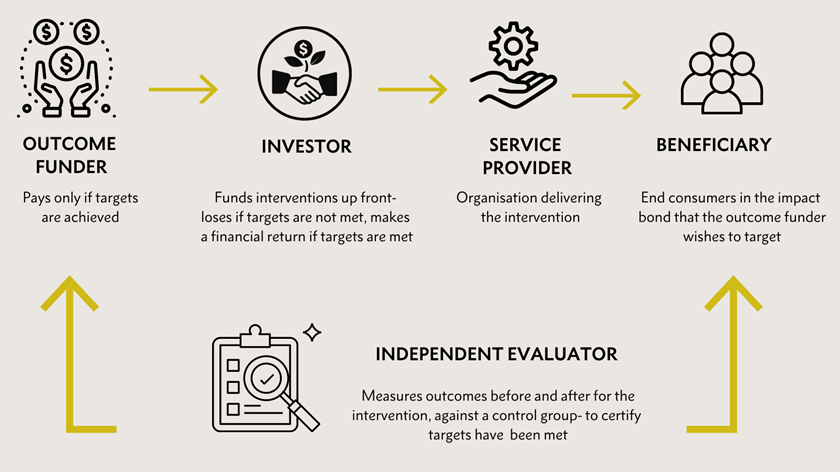

As with any transaction, it is critical to understand how the cashflows work and how money flows between the respective parties (refer to Figure 1). Clarity on this will inform how parties allocate the financial risks and rewards in the transaction documentation relating to the impact bond. This can include consideration of any back-to-back funders for either the outcome payer or the risk investor as well as any incentive payments for over performance of any baseline set for the intervention. Furthermore, if there is an intention to return any money to external investors as part of the structure, the transaction may well become significantly more complex due to compliance with rules on collective investments schemes and Financial Services and Markets Act 2000 (FSMA). In order to allow for time to consider these issues, the return of money to investors should be considered at the outset of the transaction, as part of the cash flow mechanics.

From a financial regulatory perspective, it is important that the deal is structured in such a way that it does not trigger regulations associated with “money remittance”, which is a financial regulated activity in the UK. If such activity is determined to be “money remittance”, the provider may be (subject to certain exemptions) required to obtain authorisation from the Financial Conduct Authority (FCA) to provide the service.

As these projects are usually based in developing countries, there will be several local regulatory considerations as well. Our experience has been to focus, in particular, on the tax consequences relating to money movements in and potentially out of the relevant jurisdiction as well to consider whether there are any restrictions on money remittance and whether appropriate regulatory consents are needed. This is particularly true in developing country contexts, especially in South Asia where we have worked closely with the British Asian Trust. Working with a trusted local law expert is often key at the structuring stage to ensure that an impact bond does not need to be restructured once document drafting has started.

2. Are there any restrictions on parties entering into the structure?

When initially considering these structures, one of the first questions should relate to the capacity of the parties involved to enter into the transaction. In particular, whether there any restrictions for example, do the constitutional documents of the parties involved place any limits on entry into these documents?

Since many of these structures involve service providers (or other not-for-profit entities) there are several overarching principles which one must be cognisant of:

- Does the described activity contradict the general understanding of charitable purposes?

- How will the transaction be documented?

- How will any “related party transaction” entered into as part of this structure be disclosed?

Other than the standard requirements for entering into transactions (such as internal board approvals), it is often advisable to prepare a position paper describing the structure, together with risks, regulatory and compliance concerns. This can then be provided to the board of directors along with the appropriate internal authorisation, such as board minutes, or written resolutions. Overall, this provides good evidence that the board of directors have passed a well-informed decision.

3. What is the tax treatment of the transaction, especially with respect to how grants are received and on-paid?

The general position is that a UK service provider structured as a company is exempt from corporation tax on the grants it receives, provided it uses them for charitable purposes. These charitable purposes are set out in a service provider’s constitutional documents. As always, a service provider will need to take reasonable steps to ensure that any grant money it pays on (either in the form of initial funding or outcome payments) is used by the recipients for charitable purposes.

Similarly, with grants on-paid by a service provider, it must be able to show that it has taken reasonable steps to ensure that the grant payments it makes will be applied for charitable purposes only. Such grants must also be in the service provider’s best interests. Otherwise, the payments may not be treated as charitable expenditure and could affect service provider status tax reliefs. This can be documented through internal approvals at a service provider (such as board minutes) and potentially by including specific contractual provisions in the transaction documents.

4. What safeguards need to be included in the structure?

Service providers are used to imposing particular safeguards in these transactions as a matter of standard. Such safeguards include anti-bribery, ethical behaviour, sanctions language, amongst others. Such safeguards are not only meant to shield the parties from liability in the structure but look to ensure the safety of the beneficiaries of any intervention funded by the impact bond. In the structuring phase of the transaction, it should be discussed early on who will be responsible for imposing these safeguards on the service providers carrying out the intervention. In addition, the concept of monitoring compliance against these safeguards should be discussed, in particular who will be responsible for monitoring compliance and significantly, what are the consequences of any breaches for the parties concerned and on the impact bond structure.

As part of the conversation around safeguards, it is important to bear in mind the governing law of the transaction documents at an early stage, as these can have a significant impact on the structure of the transaction. In particular, government agencies are often prohibited from signing documents which are governed by laws other than their own. As such, this should be included as a consideration during the initial structuring phase and not left until documents are drafted.

5. How can currency risk be mitigated and who takes the currency risk?

Typically grants will be made in US Dollars, Euros, Pounds Sterling or Swiss Francs. As is often the case service providers will want to be paid in local currency. Hedging (in particular, swaps or forward purchase of currency) may be entered into to mitigate this risk but this can often be an expensive option. In addition, in some emerging markets, currency swaps are not commercially available and it may be that either the investor or the outcome payer will need to ultimately bear this risk, and this should be considered when the transaction is being structured.

May 2021.

By Andrzej Janiszewski and Nathan Menon.

Reed Smith is our legal partner for the QEI DIB. Andrzej Janiszewski is a partner and Nathan Menon a senior associate in the Social Impact Finance Group at Reed Smith, based in their London office.